Financial Services

NUIX NEO for

FINANCIAL SERVICES

Count on Nuix to safeguard data, ensure compliance, and defend against emerging threats

Count on Nuix

FINAnCIAL INSTITUTIONS

COUNT ON NUIX

The financial services sector is a prime target for cyberattacks, fraud, and regulatory scrutiny. With data breaches costing institutions an average of $6.08 million in 2024 – 22% higher than the global average* – the stakes have never been higher.

Nuix Neo equips financial services organizations with the technology to identify, classify, and protect sensitive data with unmatched precision. Nuix Neo combines advanced AI, automation, and actionable insights to streamline information access request processing, supercharge Early Case Assessment (ECA), simplify regulatory compliance, and strengthen breach readiness.

Join the 84 financial institutions who count on Nuix to stay compliant, reduce risks, and protect their reputation.

Key Challenges

KEY CHALLENGES

Financial institutions are navigating an increasingly volatile risk landscape marked by insider threats, sophisticated fraud, relentless cyberattacks, and rising compliance pressure. Malicious insiders, synthetic identities, and AI-driven fraud tactics exploit fragmented systems and manual processes, making early detection and response difficult. Meanwhile, the surge in DSARs and global data privacy laws amplifies the operational burden and financial stakes. The challenge today is not just about protection – it’s about achieving real-time visibility, intelligent automation, and regulatory agility to safeguard data, mitigate loss, and preserve trust.

Safeguarding Sensitive Data

With financial and personal data under constant threat, breaches are no longer just costly – they damage trust and trigger regulatory penalties. Financial institutions must gain full visibility across systems, stay compliant with GDPR, PCI-DSS, and CCPA, and shift from reactive security to proactive, data-driven protection.

Managing Information Access Requests (DSARs)

With DSAR volumes surging, financial institutions face mounting pressure to respond quickly and accurately. Manual workflows, tight regulatory deadlines, and fragmented data slow response times; increasing the risk of penalties, litigation, and lost trust. The challenge is scaling compliance while maintaining speed, accuracy, and operational efficiency.

Emerging Fraud Tactics + Insider Threats

As fraudsters harness AI and advanced tech to exploit vulnerabilities, threats like synthetic identity theft and money laundering are growing more sophisticated. Direct and indirect costs of fraud, averages $4.41 in operational expenses for every $1 lost. Financial institutions must uncover hidden patterns in fragmented data, manage escalating fraud costs, and detect complex schemes, all while navigating mounting AML compliance pressure.

Evolving Regulatory Requirements

Global and regional regulations are in constant flux, as frameworks like GDPR, CCPA, AML, and Basel III evolve, financial institutions must move quickly or face fines, operational disruption, and reputational damage. The challenge today isn’t awareness – it’s adaptability, speed, full data visibility, and the ability to embed compliance into every layer of the organization.

Data Silos and Fragmentation

Dispersed data systems undermine fraud detection, compliance, and insider threat response, slowing action and increasing risk. Financial institutions need better access and understanding of their data landscape, automation to replace manual inefficiencies, and smarter reporting to drive informed decisions.

Safeguard Sensitive Data

SAFEGUARD

SENSITIVE

DATA

DATA BREACH READINESS

Nuix Neo allow you to proactively reduce vulnerabilities, eliminate unnecessary or duplicate data, and met global compliance standards:

💠 Identify high-risk data across banking, payment, and third-party systems.

💠 Analyze data to gain automated insights to improve risk management and governance.

💠 Minimize exposure by removing outdated, duplicate or redundant data that increases breach risks.

💠 Protect customer trust with advanced protocols, proactive security measures and breach response within regulatory mandated timeframes.

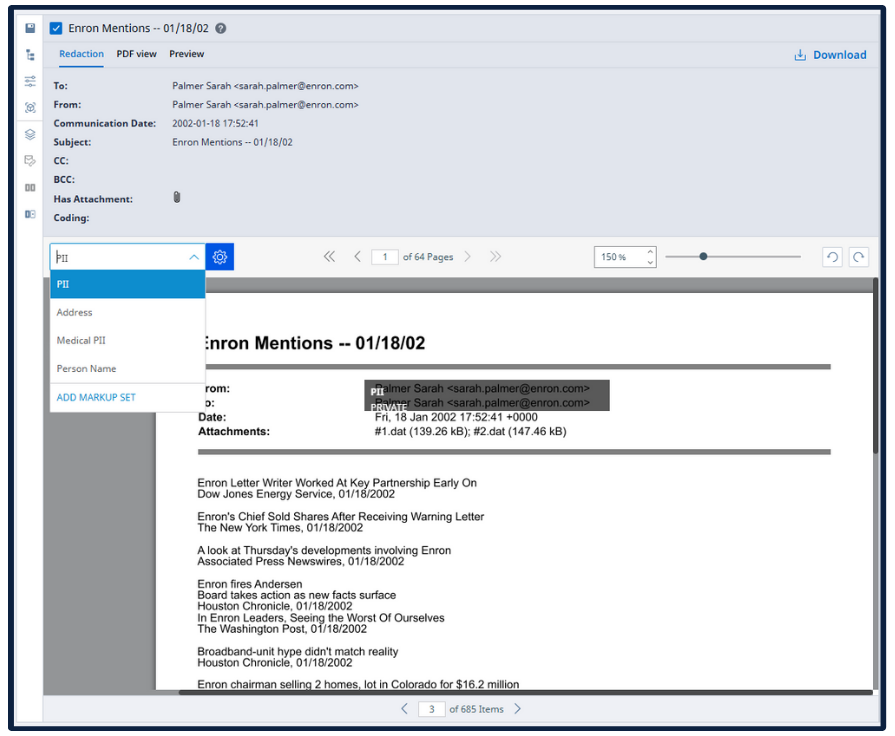

MANAGING INFORMATION ACCESS REQUESTS (DSARs)

Nuix Neo slashes DSAR response times by 95% through automation and AI-driven precision:

💠 Pinpoint relevant documents across siloed systems with forensic speed and accuracy.

💠 Redact sensitive financial and PII data automatically using proprietary AI-powered models and workflows.

💠 Report efficiently with streamlined, hyperlinked reports that maintain compliance clarity.

Supercharge Investigations

SUPERCHARGE INVESTIGATIONS

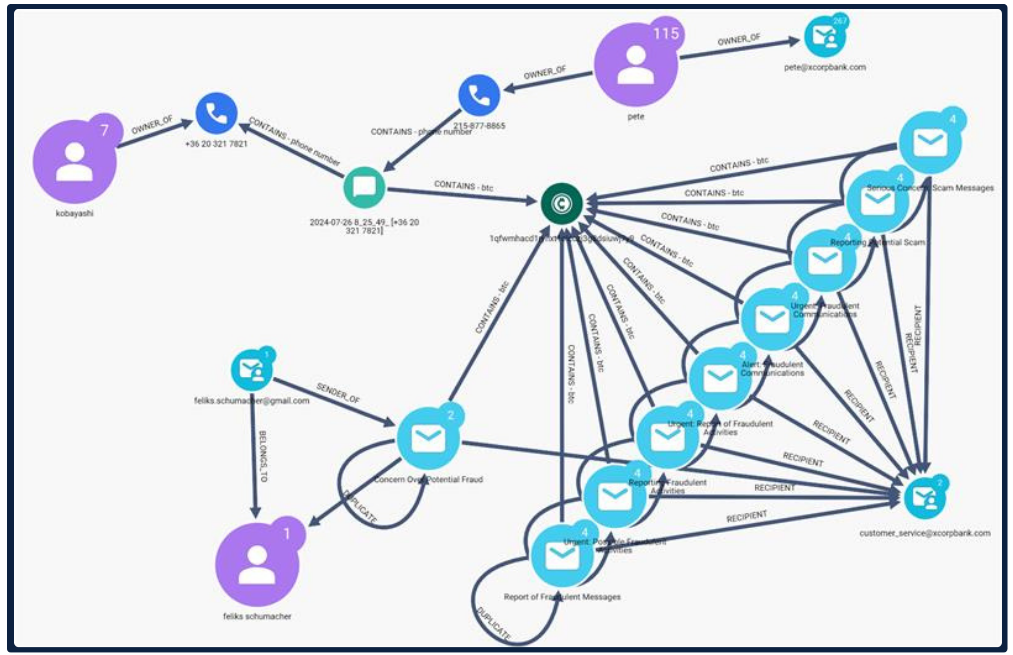

Fraud investigations

Nuix Neo takes fraud detection and investigations to new heights with AI-tuned insights:

💠 Decode Language Patterns to identify fraudulent intent in complex communication logs.

💠 Uncover Relationships using relationship mapping and entity linking to reveal hidden connections across datasets.

💠 Accelerate Investigations with industry-leading processing that drastically reduce forensic timelines while protecting profitability and reputation.

insider threat

Nuix Neo empowers financial institutions to mitigate insider risks with advanced analytics and automation:

💠 Detect Threats: Spot suspicious behavior and exfiltration attempts across banking and payment systems in near real-time.

💠 Uncover relationships and connections using AI-driven analytics to prevent data misuse.

💠 Accelerate Investigations: with industry-leading processing and automated workflows that can build activity timelines fast.

💠 Strengthen governance with automated monitoring and reporting to ensure compliance with regulations like GDPR, GLBA, AML Directives, BSA, and PCI-DSS.

💠 Act Fast: Unite data for real-time, team-wide insights and prioritize high-risk indicators and automate responses instantly.

REGULATORY COMPLIANCE

Nuix Neo empowers financial institutions to stay ahead of evolving regulations, streamlining compliance across jurisdictions and languages. Protect your business from fines, disruptions, and reputational risks with Nuix:

💠 Monitor global and regional regulatory updates like GDPR, GLBA, PCI-DSS, BSA, and AML directives in real-time.

💠 Simplify Compliance: Automate workflows to meet stringent requirements and reduce audit burdens.

💠 Unify Data: Consolidate fragmented systems for seamless compliance reporting and oversight.

💠 Mitigate Risks: Proactively address noncompliance risks to avoid fines, disruptions, and reputational harm.

💠 Drive Efficiency: Streamline compliance processes to free up resources and focus on growth.

ANTI-MONEY LAUNDERING

Nuix Neo empowers financial institutions to tackle stringent AML regulations with precision and speed:

💠 Uncover Hidden Risks: Analyze vast, unstructured data to reveal patterns and suspicious activities.

💠 Streamline Investigations: Automate workflows to reduce manual effort and accelerate compliance.

💠 Enhance Reporting: Generate auditable, regulator-ready reports with responsible AI.

💠 Boost Efficiency: Reduce false positives and optimize resources for faster compliance.

💠 Stay Ahead: Detect emerging money laundering trends and maintain adherence to global standards.

Scale Legal Processing + Review

Scale

Legal Processing

+ Review

INSOURCE EDISCOVERY

Take control and insource Legal Processing and Review, reducing costs, do more with the team you have and maintain security and compliance. With Nuix Neo you can:

💠 Reduce Review Costs: Eliminate up to 95% of non-responsive data early with advanced AI-driven reduction.

💠 Protect Sensitive Data: Keep PII and IP secure within your firewall, automating redaction before external sharing.

💠 Streamline Workflows: Automate eDiscovery tasks like data collection, legal hold, and analysis to save time.

💠 Identify Gaps: Pinpoint missing data or inconsistencies in collections or opposing counsel productions.

💠 Regain Control: Centralize eDiscovery processes for full visibility, compliance, and oversight, reducing reliance on third parties.

💠 Scale: Handle large, time-sensitive projects with scalable resources and seamless integrations.

EARLY CASE ASSESSMENT

Accelerate your Early Case Assessment (ECA) process, saving time, costs, and resources – with Nuix Neo you can:

💠 Analyze Case Data: Leverage AI to uncover insights with keyword searches, clustering, and predictive coding.

💠 Identify Gaps: Spot inconsistencies in collections or opposing counsel productions instantly.

💠 Minimize Risk: Review similar cases to inform strategy and reduce legal uncertainties.

💠 Reduce Data: Cut review data by 64% to save time and costs.

💠 Act Fast: Make strategic, data-driven decisions quickly and confidently.

LEGAL REVIEW

Nuix Neo empowers financial organizations to revolutionize legal review with speed, precision, and flexibility:

💠 Start Fast: Ingest data and begin reviewing in minutes with no load files or exports.

💠 Analyze Case Data: Leverage AI-driven tools like predictive coding and concept clustering for strategic insights.

💠Identify Gaps: Pinpoint missing data or inconsistencies in collections or opposing counsel productions.

💠 Minimize Risk: Automate PII identification and redaction to ensure compliance and confidentiality.

💠Rapid Review: Streamline workflows with advanced automation, reducing manual effort and expediting decisions.

💠 Deploy Your Way: Deploy in cloud, on-prem, or hybrid environments to suit your business and compliance needs.

Speak to an expert or request a demo TODAY

See for yourself how our innovative software can transform your data into actionable intelligence and help answer your biggest data challenges.

If your browser is experiencing any issues with the form on this page, click here to open it in a new window.